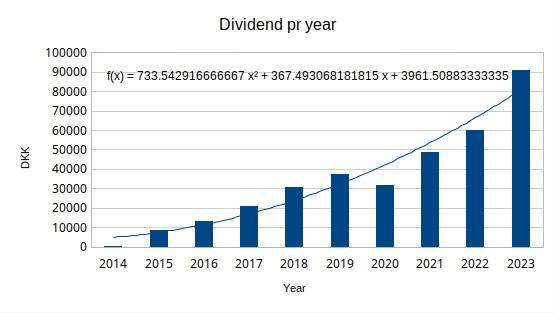

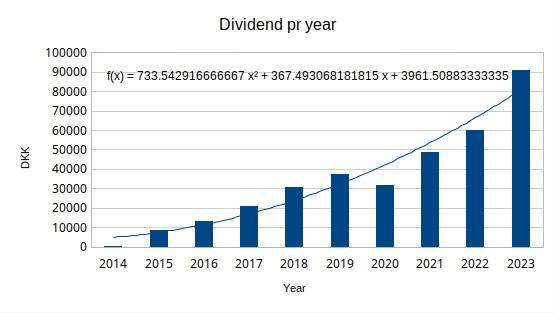

Hvis man kan stole på andengrads polynomiske formel , som Calc har lavet baseret på de sidste 10 års udbytte, så ville jeg ende med omkring 15.000 kr. i udbytte pr måned efter skat om 10 år.

Dividends

Hvis man kan stole på andengrads polynomiske formel , som Calc har lavet baseret på de sidste 10 års udbytte, så ville jeg ende med omkring 15.000 kr. i udbytte pr måned efter skat om 10 år.

Så er der gået endnu end måned og jeg har fået udbytte fra:

| Broadcom | 324.2 |

| Cisco Systems | 190.54 |

| Coca-Cola Company (The) | 393.14 |

| Frontline | 3364.2 |

| Merck & Company, Inc. | 273.89 |

| Novozymes B A/S | 462 |

| Oracle | 158.37 |

| Orion Office REIT | 3.54 |

| Pepsico | 267.46 |

| Philip Morris International Inc | 229.8 |

| Realty Income Corp. | 90.68 |

| Tryg A/S | 397.75 |

| I alt | 6155.57 |

Dette er en stigning på 26% i forhold til Juni 2022 (https://financialindependent.finance.blog/2022/11/03/udbytte-i-oktober-2022/ ). Ovedsagelidt skyldes dette at Frontlines udbytte er steget fra 665.01 dkk til 3364.2.

Der ud over er mine 135 Activison Blizzard aktier blevet udskiftet til 142 3M aktier (https://financialindependent.finance.blog/2023/10/17/3m-2/ ) takket være Microsoft opkøb af Activison Blizzard

Derud over har jeg også fået suppleret op med 75 Bolidan aktier (https://financialindependent.finance.blog/2023/10/28/bolidan/).

Til dem der ikke kender mig så er mit mål af få dækket mine kedelige udgifter via udbytte .

Lige nu ligger de på ca:

Husleje: 5.500 dkk

Utils: 2.000 dkk

Mad: 2.000 dkk

Div. 1.000 dkk

Skat: 18.000 dkk

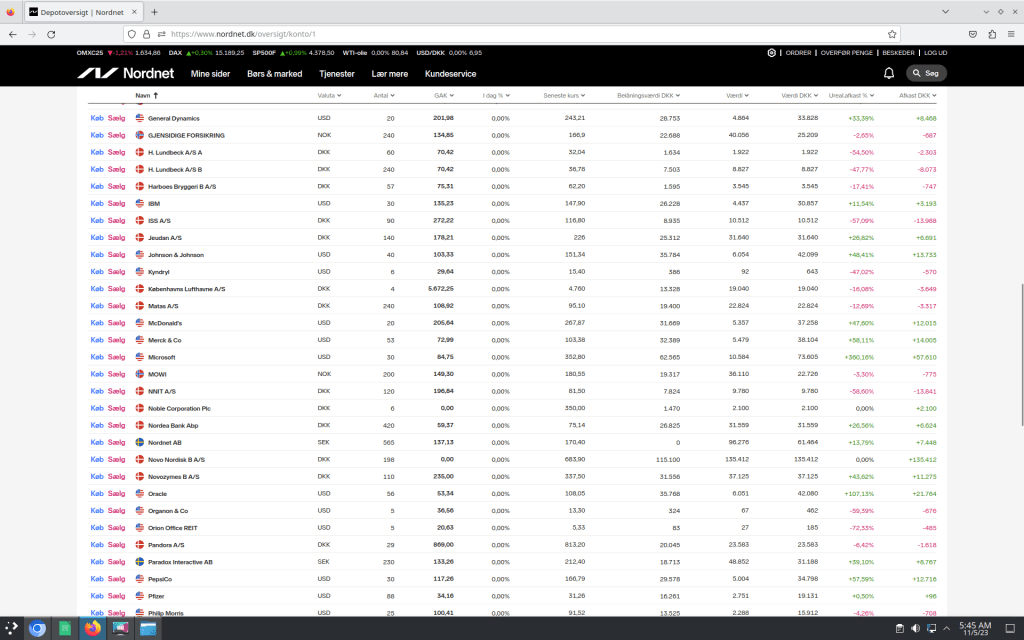

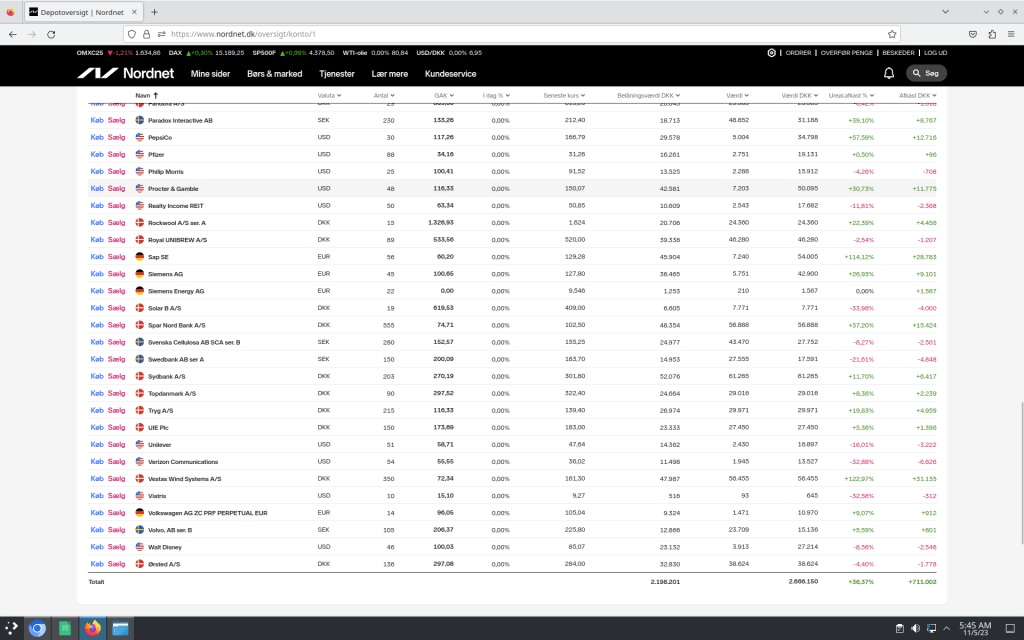

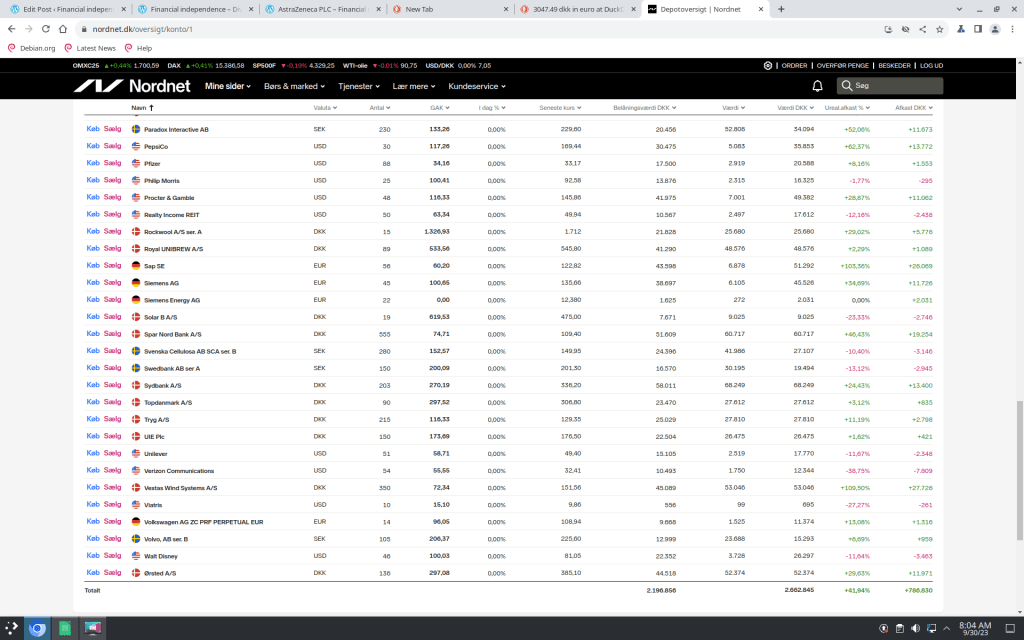

I skrivene stund er mit portfolio på 2.666.150 dkk hvoraf 711.002 dkk ikke er reliseret endnu. Og jeg har fået 90651.23 dkk igennem det sidste 12 måneder. Det giver en gennemsnitlig ekstra indkost på 7554.27 dkk pr måned igennemsnit.

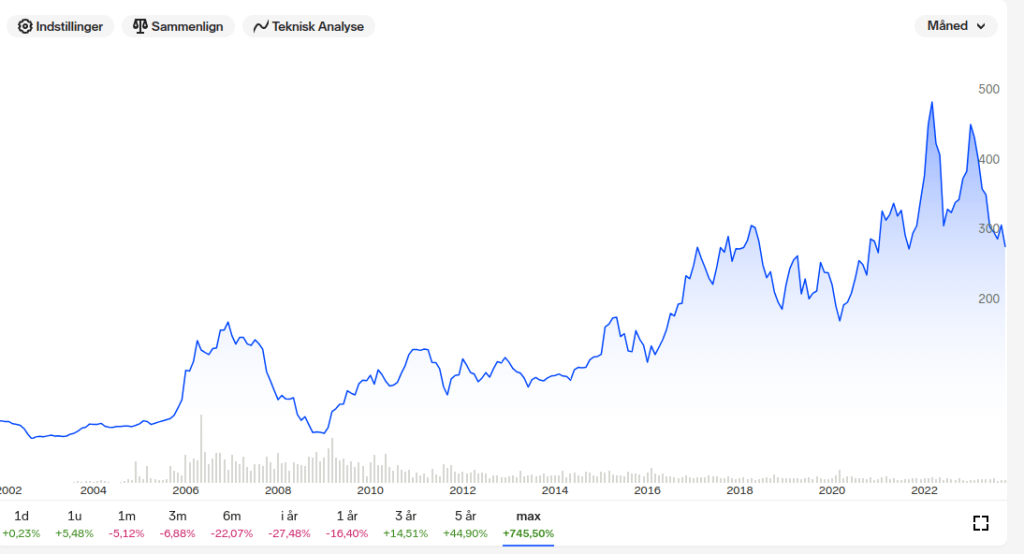

Så er det ved at være lønningsdag igen og jeg er ved at kigge på nye aktier. Jeg har kigget på Bolidan (https://www.nordnet.dk/markedet/aktiekurser/16100497-boliden).

Når jeg ser på deres graf ser jeg at den er stødt stigene:

Dog stiger den ikke så meget som jeg kunne ønske mig samt at der er noge udsving på den som ikke er optimal.

Jeg kan se at den i skrivene stund har en P/E på ca 11 hvilket er extremt billigt. Og en P&B på 1.3 hvilket også er en godt tal. Der ud over har de en udbytte procent på over 9% hvilekt også er godt.

De har mere end fordublet deres resultat efter skat fra 5.788 MSEK 2019 til 12.410 MSEK 2022. Så jeg forventer at få suppleret op i denn aktie på tirsdag.

Activision Blizzard has been taken over by Microsoft and this means that I now have a little extra money I can buy shares with.

I have therefore looked at 3M (https://www.nordnet.dk/markedet/aktiekurser/16122104-3-m).

The P/E is extremely low and is around 9. Their dividend percentage is over 6%, which is very high.

This may be because their expected growth is negative and we have therefore seen the share price fall quite a bit.

Since it is a Dividend Aristocrats, I expect them to come back on top

Another month have past so time for a dividend update. I have received 3047.49 dkk/408.11 euro in September from those companies:

| 3M | 218.74 |

| Amgen Inc. | 236.83 |

| AstraZeneca PLC | 90.62 |

| Dow | 418.34 |

| Exxon Mobile corp | 253.12 |

| International Business Machines Corporation | 346.3 |

| Johnson & Johnson | 331.46 |

| McDonalds | 212.16 |

| Microsoft | 142.71 |

| Marine Harvest | 260.47 |

| Noble Corporation Plc | 12.49 |

| Organon & Co. | 9.79 |

| Pfizer, Inc. | 250.52 |

| Realty Income Corp. | 89.34 |

| unilever | 166.21 |

| Viatris | 8.39 |

This is more or less the same as September last year (https://financialindependent.finance.blog/2022/10/01/september-20222/).

I have also added 12 stocks of AstraZeneca PLC ( https://financialindependent.finance.blog/2023/04/28/astrazeneca-plc/ ) to my portfolio.

For those who don’t know me then my goal is to cover my boring expenses through dividends. Right now they are at approximately:

Rent: 5.500 DKK/740 euro

Utils: 2.000 dkk

Food: 2.000 dkk/270 euro

Miscellaneous: 1.000 dkk/130 euro

Tax: 18.000 DKK/2400 Euro

At the time of writing, my portfolio is 2.662.845 DKK/356,646.93 euro , of which 786.830 DKK/ 105,383.72 euro has not been realized yet. And I’ve gotten 87510.66 DKK/11,719.72 euro over the last 12 months. This gives an average extra diet of 7292.56 DKK/ per month on average.

I am close to reaching my first FI goal. That is my LeanFI of 1.000 euro. Currently I am getting 980 euro in dividend (on avg) pr month. This is like living as a student in Denmark. My next goal is 2.000 euro in dividend income pr month on avg (That should cover my normal expensive).

Another month have past so time for a dividend update. I have received 5329.1 dkk in August from those companies:

| AbbVie Inc. | 323.13 |

| Activision Blizzard. Inc | 916.04 |

| Apple | 131.6 |

| Colgate-Palmolive Company | 131 |

| D/S Norden | 630 |

| general dynamics corporation | 179.71 |

| Novo Nordisk B A/S | 594 |

| Procter & Gamble Company (The) | 308.07 |

| Realty Income Corp. | 87.16 |

| United International Enterprises Ltd | 1789.5 |

| Verizon Communications Inc. | 238.89 |

| Total | 5329.1 |

This is an increase of 185% from last year ( https://financialindependent.finance.blog/2022/07/30/1310/ ) and is mainly due to extra dividend from Activision Blizzard. Inc, D/S Norden and United International Enterprises Ltd.

I have also added 36 stock from the Danish company called Ørsted (https://financialindependent.finance.blog/2023/08/30/orsted/ ).

For those who don’t know me then my goal is to cover my boring expenses through dividends. Right now they are at approximately:

Rent: 5.000 DKK

Utils: 2.000 dkk

Food: 2.000 dkk

Miscellaneous: 1.000 dkk

Tax: 18.000 DKK

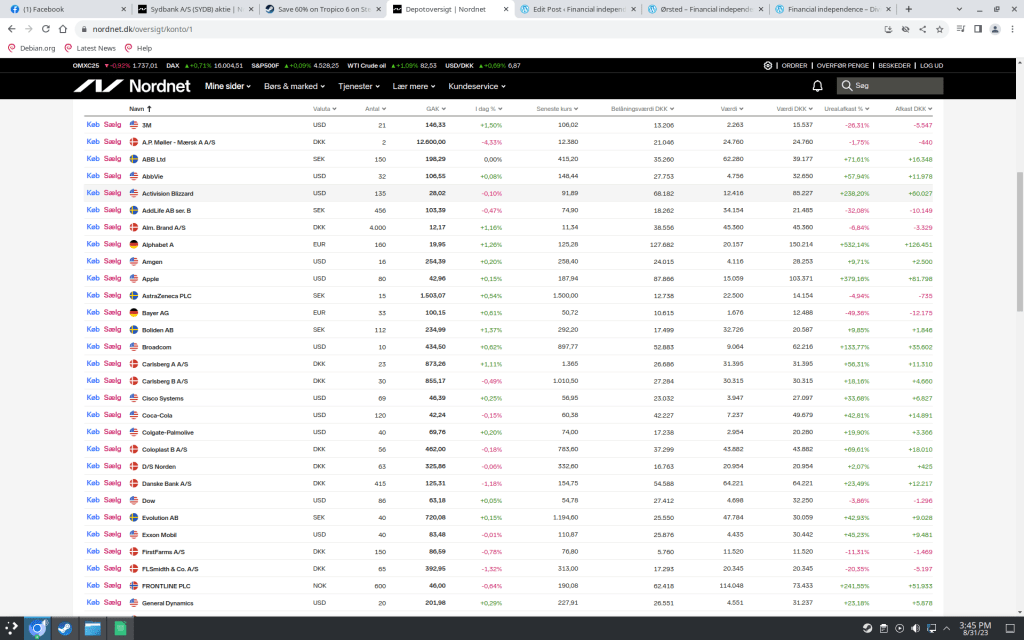

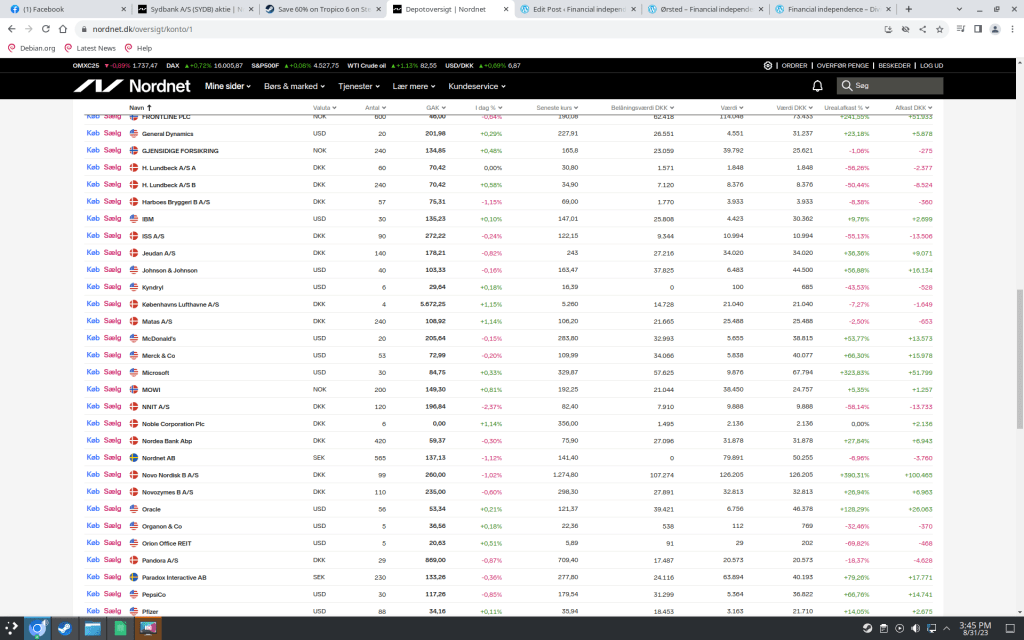

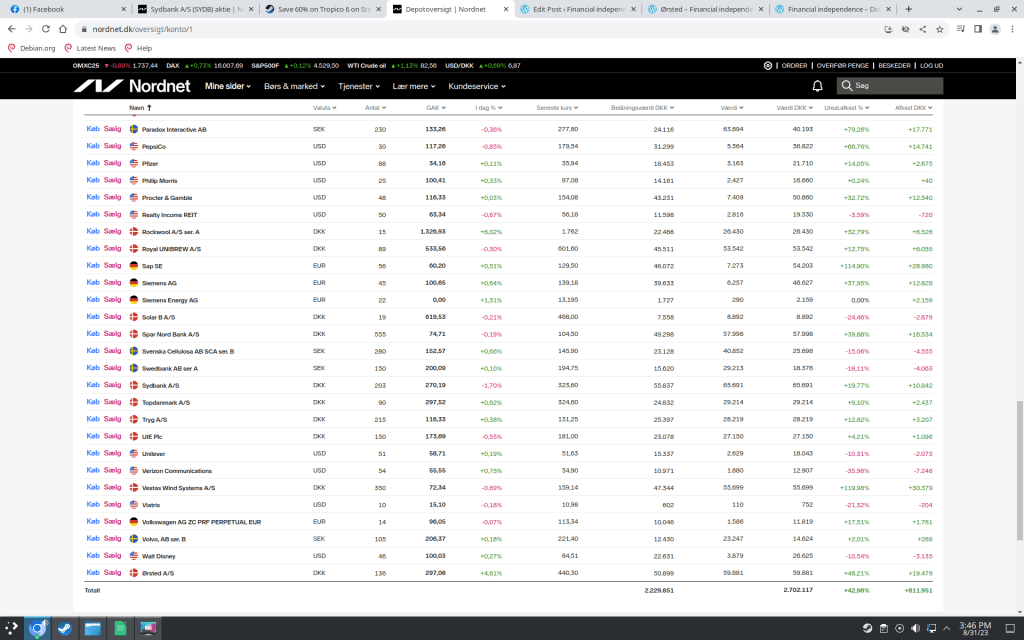

At the time of writing, my portfolio is 2.702.117 DKK, of which 811.951 DKK has not been realized yet. And I’ve gotten 87546,26DKK over the last 12 months. This gives an average extra diet of 7295,52 DKK per month on average.

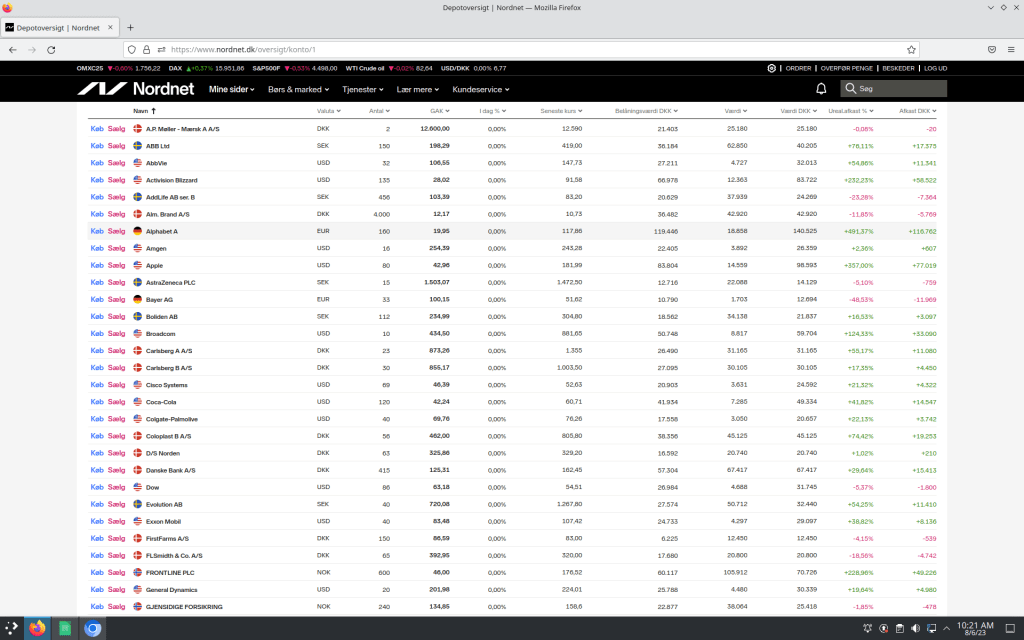

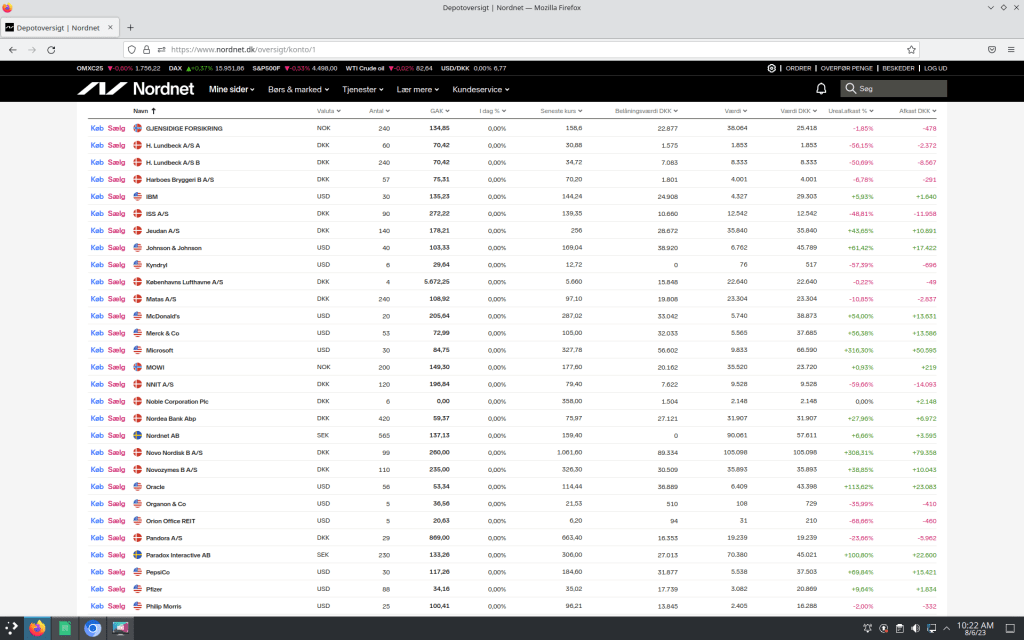

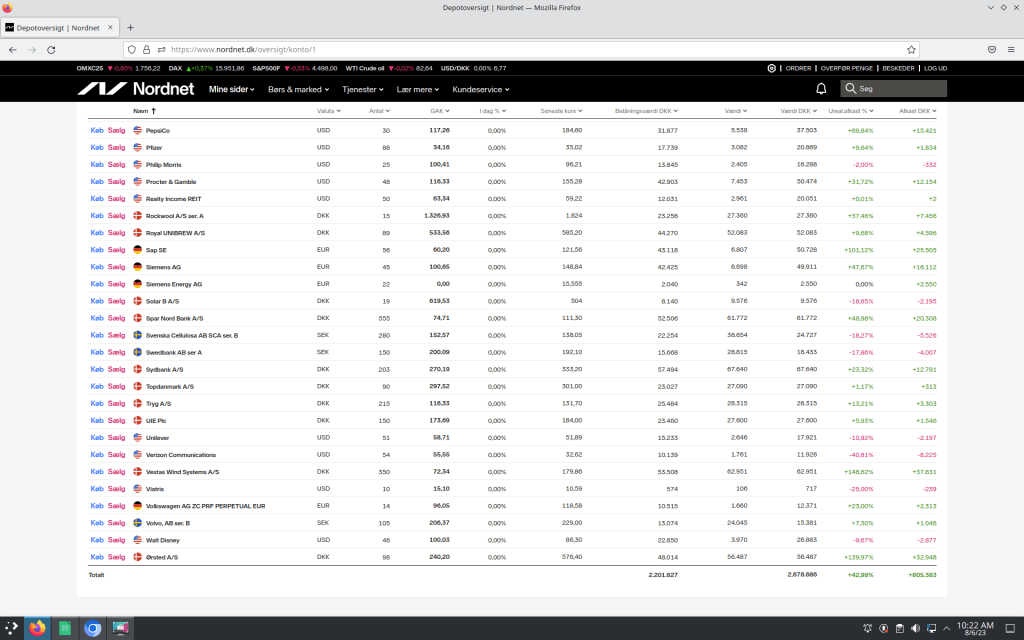

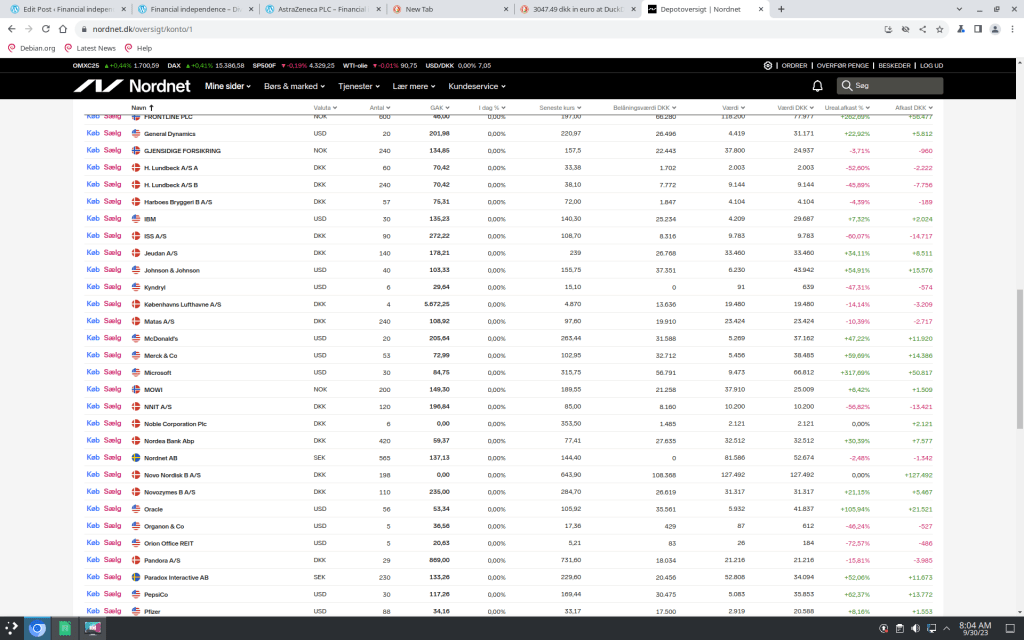

My portfolio looks like this right now;

Ørsted (https://www.nordnet.dk/markedet/aktiekurser/16557154-orsted) is a danish energy company. It did fall around 25% in value today so I took a closer look at the company.

The company earning (Resultat efter skat) has increased from 7.235 MDKK in 2019 to 14.996 MDKK. I think that is impressive. It also have a dividend yield of 3,21%. That is quite nice and above my target of 3%.

Ørsted P/E is on 17,32 and P/B is 1.5. I would say that it is not alarming at all.

I took the liberty to buy additional 36 shares in this company

And the year is not even ending soon so I dont have the complete data yet.

Another month have past so time for a dividend update. This time I will do it in English so I can cross post it in https://www.reddit.com/r/EuropeFIRE/ Let me know if it is an issue.

I have received 8511.68 dkk in Juli from those companies

| Broadcom | 314.84 |

| Cisco Systems | 180.36 |

| Coca-Cola Company (The) | 376.89 |

| Danske Bank A/S | 2905 |

| Frontline | 2882.67 |

| Matas | 480 |

| Merck & Company, Inc. | 261.72 |

| Oracle | 150.13 |

| Orion Office REIT | 3.31 |

| Pepsico | 259.74 |

| Philip Morris International Inc | 214.59 |

| Realty Income Corp. | 84.68 |

| Tryg A/S | 397.75 |

| Total | 8511.68 |

This is an increase of 221% from last year ( https://financialindependent.finance.blog/2022/07/30/1310/ ) and is mainly due to extra dividend from Danske Bank and Fronline.

I have also added 186 stock from the Swedish company called Addlife ( https://financialindependent.finance.blog/2023/07/21/addlife-2/ ).

For those who don’t know me then my goal is to cover my boring expenses through dividends. Right now they are at approximately:

Rent: 5.000 DKK

Utils: 2.000 dkk

Food: 2.000 dkk

Miscellaneous: 1.000 dkk

Tax: 18.000 DKK

At the time of writing, my portfolio is 2.678.686 DKK, of which 805.383 DKK has not been realized yet. And I’ve gotten 84086.88 DKK over the last 12 months. This gives an average extra diet of 7007.24 DKK per month on average.