Another month have past so time for a dividend update. This time I will do it in English so I can cross post it in https://www.reddit.com/r/EuropeFIRE/ Let me know if it is an issue.

I have received 8511.68 dkk in Juli from those companies

| Broadcom | 314.84 |

| Cisco Systems | 180.36 |

| Coca-Cola Company (The) | 376.89 |

| Danske Bank A/S | 2905 |

| Frontline | 2882.67 |

| Matas | 480 |

| Merck & Company, Inc. | 261.72 |

| Oracle | 150.13 |

| Orion Office REIT | 3.31 |

| Pepsico | 259.74 |

| Philip Morris International Inc | 214.59 |

| Realty Income Corp. | 84.68 |

| Tryg A/S | 397.75 |

| Total | 8511.68 |

This is an increase of 221% from last year ( https://financialindependent.finance.blog/2022/07/30/1310/ ) and is mainly due to extra dividend from Danske Bank and Fronline.

I have also added 186 stock from the Swedish company called Addlife ( https://financialindependent.finance.blog/2023/07/21/addlife-2/ ).

For those who don’t know me then my goal is to cover my boring expenses through dividends. Right now they are at approximately:

Rent: 5.000 DKK

Utils: 2.000 dkk

Food: 2.000 dkk

Miscellaneous: 1.000 dkk

Tax: 18.000 DKK

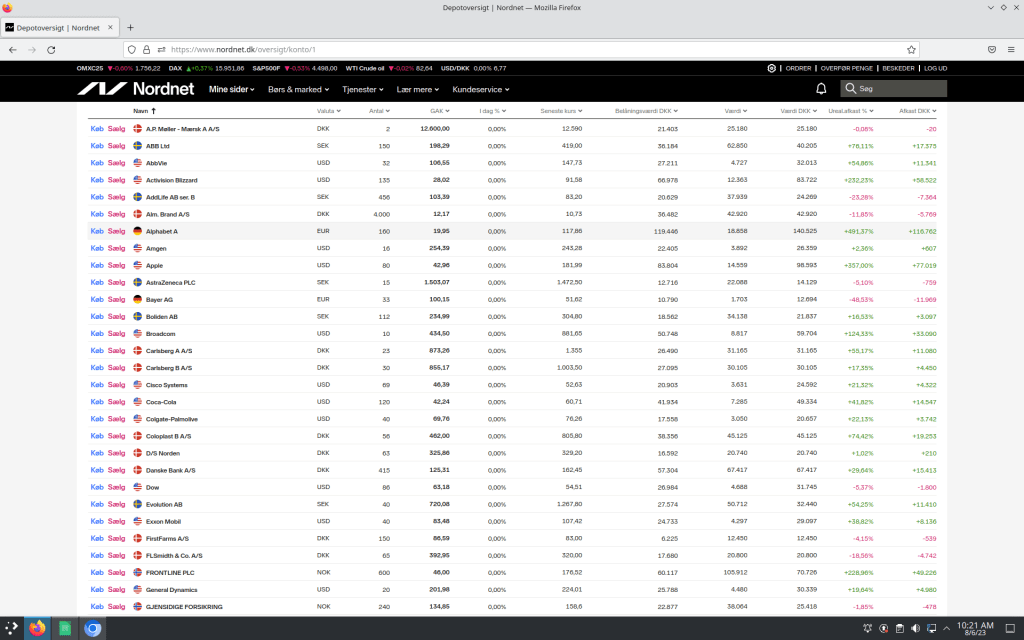

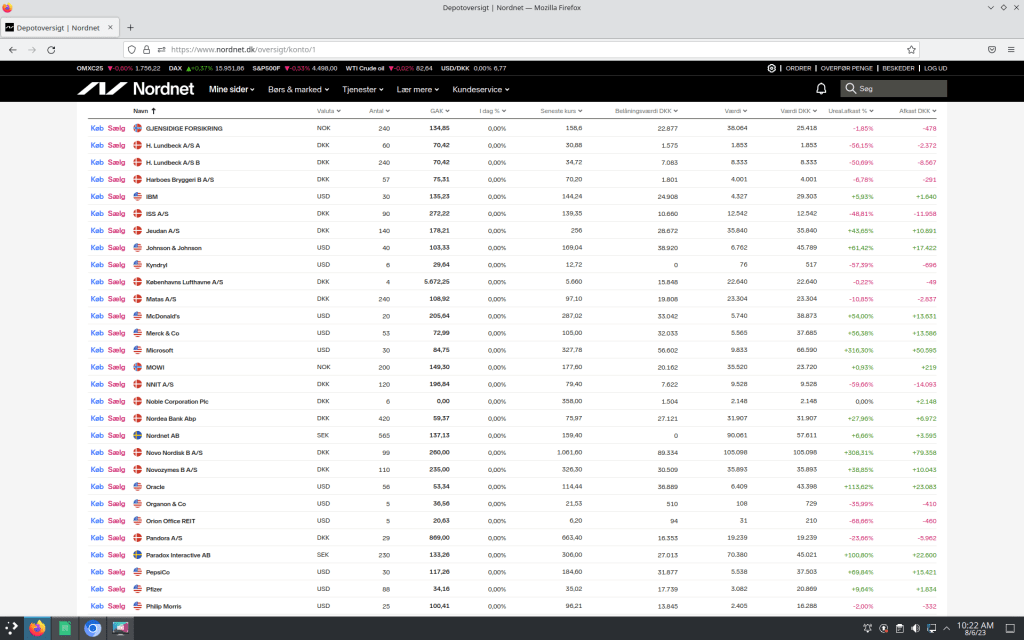

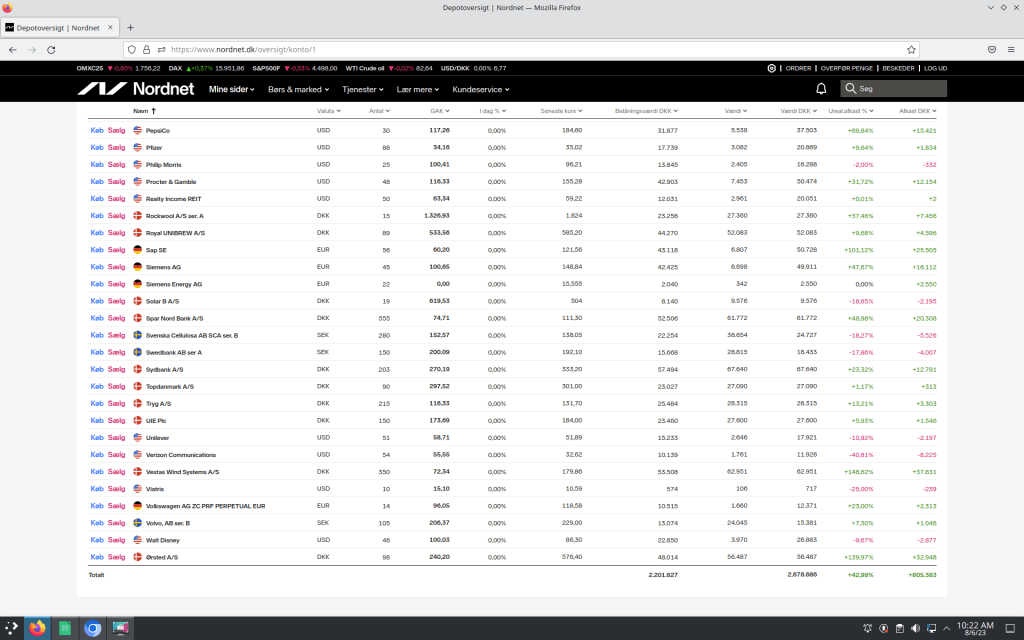

At the time of writing, my portfolio is 2.678.686 DKK, of which 805.383 DKK has not been realized yet. And I’ve gotten 84086.88 DKK over the last 12 months. This gives an average extra diet of 7007.24 DKK per month on average.

What does average “diet” means? Capital gain?

LikeLike

Ups something went wrong with my translation. It should not have been diet but income instead

LikeLike